On March 4, the Trump administration of the United States officially imposed an additional 10% tariff on all goods imported from China, adding to the 10% that had already taken effect, bringing the cumulative tariff rate to 20%. At the same time, the United States announced a 25% tariff on imports from Canada and Mexico, citing the “fentanyl issue,” and pressured the two countries to follow its policy of increasing tariffs on China. It directly impacts China’s tyres export business to the North American market, especially the tire industry that is highly dependent on the U.S. market. It will face multiple crises such as a 20%-25% cost tire tariff, weakened price competitiveness, and loss of orders.

Summary of North American Tyres Market Data in 2024

Demand recovery and structural differentiation

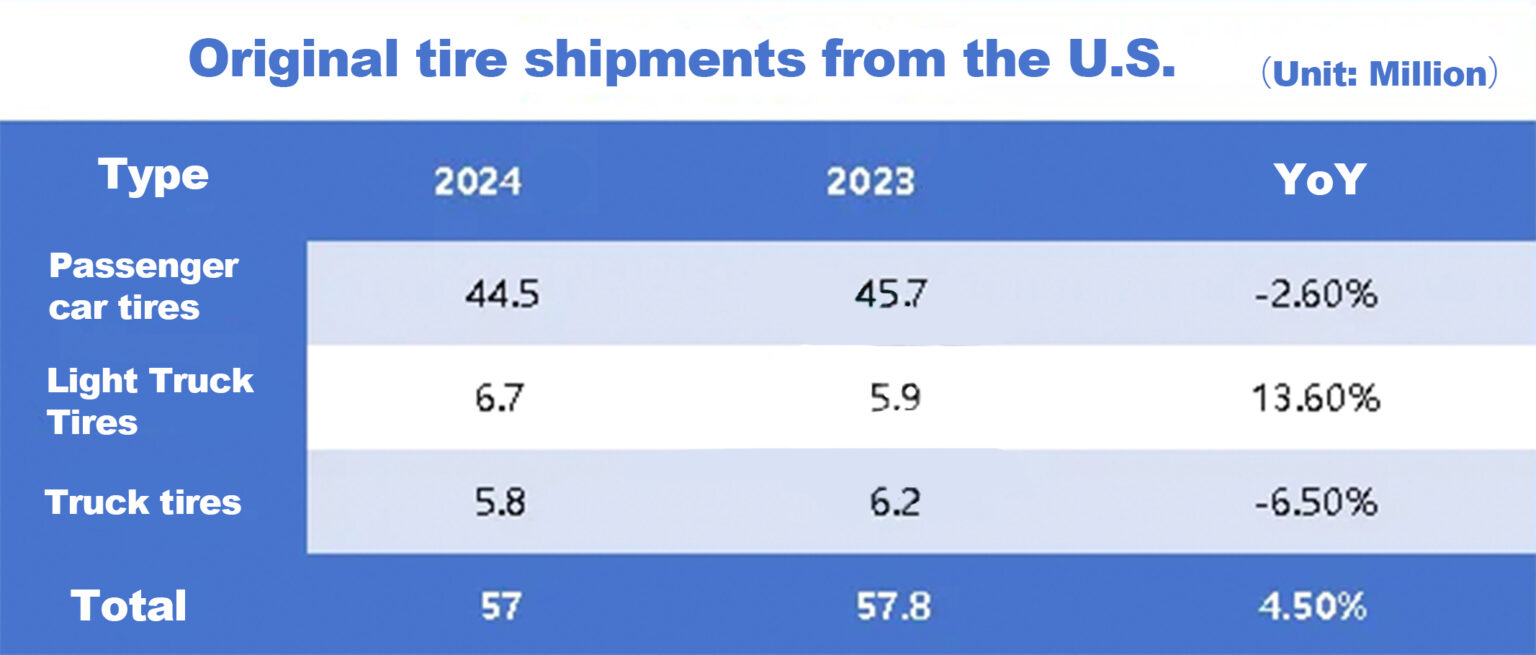

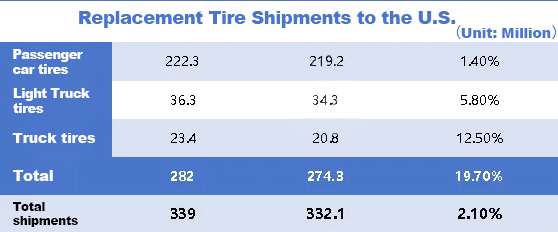

According to the forecast data of the United States Tire Manufacturers Association (USTMA), the total shipment of tires in the United States is expected to reach 338.9 million in 2024, a year-on-year increase of 2.1%, setting a record high. The replacement tyre market is expected to ship 282 million tires (year-on-year +2.8%), of which the demand for truck tire replacements increased by 12.5% and the demand for light truck tire replacements increased by 5.8%. However, the performance of the original equipment tyre market is differentiated: the shipments of passenger car and truck original equipment tires decreased by 2.6% and 7.0% respectively, while the original equipment tires of light trucks increased by 14.6% against the trend.

Overview of China’s Tyre Export Data in 2024

- Car Tire Export

In 2024, China’s total tyres exports of passenger car tires were US$8.994 billion, a year-on-year increase of 14.17%; the export volume was 348.921 million units, a year-on-year increase of 13.42%.

- Truck Tire and Bus Tire Export

In 2024, China’s total tyres exports of truck and bus tires were US$9.873 billion, a year-on-year decrease of 2.07%; the export volume was 126.6501 million units, a year-on-year increase of 2.05%.

The Current Situation and Future of the Mexican Tire Industry

According to relevant data, Mexico’s current annual tire production capacity has exceeded 65 million passenger car tire / light truck tires and 1 million to 2 million truck tires and bus tires. With the commissioning of the new plant, Mexican tire production capacity is expected to increase by more than 35%, and is expected to exceed 100 million in the next few years.

In 2023, the United States exported 22.8 million passenger car tires and 1.79 million light truck tires, valued at more than $2 billion. With the commissioning of the new plant, U.S. tire imports from Mexico are expected to reach 40 million.

The Foresight of Chinese Tire Companies

In this tire tariff storm, the Mexican tire production capacity layout of companies such as Zhongce Rubber Tire and Sailun Tire highlights their strategic value. Since 2023, Chinese tire companies have accelerated the construction of factories in Mexico, with a total investment of more than US$1.17 billion and an additional production capacity of 24.5 million tires per year.

- Zhongce Rubber Tire: As one of China’s largest tire manufacturers, Zhongce Rubber’s tire factory in Mexico will mainly serve the North American and Latin American markets, and build a logistics center to improve delivery efficiency.

- Sailun Tire: Sailun Group Tire previously mainly exported tires to the United States from Vietnam and Cambodia, but due to the high tariffs imposed by the United States on Chinese tires, Sailun Tire chose to build a factory in Mexico to circumvent tariff barriers and better serve the North American market.

- Soft Control Tire: Soft Control Co., Ltd., through its wholly-owned subsidiary Soft Control Hong Kong, plans to invest US$19.8 million in Mexico to build its third overseas factory to serve the needs of customers in the North American market.

Forlander Tire: Forlander Tire is also planning to invest in a tire factory in Mexico to better stabilize and expand North American tire customers and markets.

In addition to Chinese companies, Japan’s Yokohama Rubber Tire also announced an investment of US$380 million to build a factory in Mexico, mainly serving the North American tyre market. These investments will further enhance Mexico’s position in the global tire industry and provide new development opportunities for Chinese tire companies.

The layout of Zhongce Rubber Tire, Forlander Tire and Sailun Tire in Mexico is not a whim, but is based on a deep insight into the global tire industry structure and trade situation.

- Avoiding trade barriers: The United States has long maintained high tariffs on Chinese tires at 30%-100%, which has greatly reduced the competitiveness of Chinese tires in the US market. By building factories in Mexico, Chinese companies can export their products to the United States as “Made in Mexico”, thereby avoiding high tariffs.

- Close to the market: Mexico has an irreplaceable geographical advantage, logistics costs are 30%-40% lower than in Asia, and the delivery cycle is shortened from 45 days to 7 days, significantly improving the efficiency and resilience of the supply chain

- Free Trade Agreement: Mexico signed the United States-Mexico-Canada Agreement (USMCA) with the United States and Canada, which facilitates the entry of Mexican-made products into the U.S. market. Sailun has to bear high anti-dumping duties when exporting to the United States from Vietnam and Cambodia, while its Mexican factory directly breaks through the tariff barriers. Chinese tire companies can take advantage of this agreement to further expand their share in the North American market.

- Global layout: Building a factory in Mexico can not only serve the North American market, but also radiate the Latin American market. This will help Chinese tire companies achieve global layout and diversify market risks. International giants such as Yokohama Rubber and Bridgestone have already built factories here, forming a mature supporting industrial chain.

In 2023, Mexico will export 24.6 million tires to the United States, with a value of over $2 billion. After the new Chinese company goes into production, Mexico’s annual tire production capacity will exceed 100 million tires, and exports to the United States are expected to double to 40 million tires. This capacity leap not only offsets the impact of tariffs, but also allows Chinese companies to gain entry to compete with local American brands.

Conclusion

The tariff upgrade on March 4 is both a crisis and an opportunity. Excellent Chinese tire companies such as Zhongce Tire, Sailun Tire and Forlander Tire have proved that through forward-looking layout, they can not only withstand the impact of the trade war, but also take advantage of the opportunity to complete the transition from “export dependence” to “global operation”. When tariff barriers force the industry to upgrade, those companies that dare to jump out of their comfort zone and embrace localization will eventually write new rules in the North American market.