On February 9, 2025, the Egyptian Ministry of Investment and Foreign Trade issued Announcement No. 4, announcing the final ruling on the anti-dumping tyre tax adjustment on Chinese and Thai truck and bus tyres. This decision may have far-reaching implications for Sino-Egyptian trade relations and the related industries. Here are the key details of the review and a deeper analysis of its potential impacts.

Egypt Tyre Tax Background

- On October 10, 2019, Egypt launched an anti-dumping investigation on truck and bus tires originating from China, India, Indonesia, and Thailand.

- On March 3, 2021, Egypt made a ruling on the case and began to impose anti-dumping duties, of which the tax rate for Chinese tire products was 9.8% to 36.9% of the CIF price; the tax rate for Thai tire products was 7.5% to 31.2% of the CIF price.

- On February 6, 2024, Egypt launched an anti-dumping mid-term review investigation on the products involved in the case from China and Thailand.

Review Results

After the adjustment, the Chinese tyre tax rate is 22% to 56% of the CIF price; the Thai tyre tax rate is 6% to 20% of the CIF price. The Egyptian tax number of the product involved is 4011200010.

The measures will take effect from the date of the announcement and will be valid for two years.

We understand that the Egyptian investigation authority may initiate a sunset review investigation before the expiration of the two-year period.

Specific tire tax rates

The taxation method of this case is the same as the original trial, which is a mixture of AD valorem tax and specific tax, whichever is higher. In other words, if the anti-dumping duty calculated according to the AD valorem duty rate is lower than the AD valorem duty, it is levied according to the AD valorem duty; If the anti-dumping duty calculated at the rate of AD valorem duty is higher than the AD valorem duty, it shall be taxed as AD valorem duty. The corporate tax rates are as follows:

| Tire Company | Tyre Tax | |

| China | Chaoyang Longmarch Tire Co., Ltd (sampling enterprises) | 34% |

| Shandong Mirage Tyres Co., Ltd (sampling enterprises) | 23% | |

| Shandong Wanda Boto Tyre Co., Ltd (sampling enterprises) | 22% | |

| Tongli Tyre Co., Ltd (sampling enterprises) | 37% | |

| Bayi Rubber Co., Ltd | 30% | |

| Shandong Yongsheng Rubber Group Co., Ltd | 30% | |

| Prinx Chengshan (Shandong) Tire Co., Ltd | 30% | |

| Qingdao Doublestar Tire Industrial Co., Ltd | 30% | |

| Double Coin Group (Jiang Su) Tyre Co., Ltd | 30% | |

| Double Coin Group (Chongqing) Tyre Co., Ltd | 30% | |

| Triangle Tyre Co., Ltd | 30% | |

| Shandong Linglong Tire Co., Ltd | 30% | |

| Shandong Huasheng Rubber Co., Ltd | 30% | |

| Shandong Shenghai Rubber Co., Ltd | 30% | |

| Weifang Shunfuchang Rubber and Plastic Products Co.,Ltd | 30% | |

| Qingdao Odyking Tire Co.,Ltd | 30% | |

| Shandong Forlander Tire Co.,Ltd | 30% | |

| Shouguang Firemax Tire Co.,Ltd | 30% | |

| Hubei Aulice Tire Co.,Ltd | 30% | |

| Shandong Changfeng Tires Co.,Ltd | 30% | |

| Shandong Hugerubber Co.,Ltd | 30% | |

| Guizhou Tire Co.,Ltd | 30% | |

| Giti Tire (Fujian) Co.,Ltd | 30% | |

| Other China companies | 56% | |

| Thailand | Bridgestone Tire Manufacturing (Thailand)Co.,Ltd | 6% |

| Sentury (Thailand)Co.,Ltd | 14% | |

| Other Thai companies | 20% |

Impact Analysis

Tire cost advantage collapses, tire market share under pressure

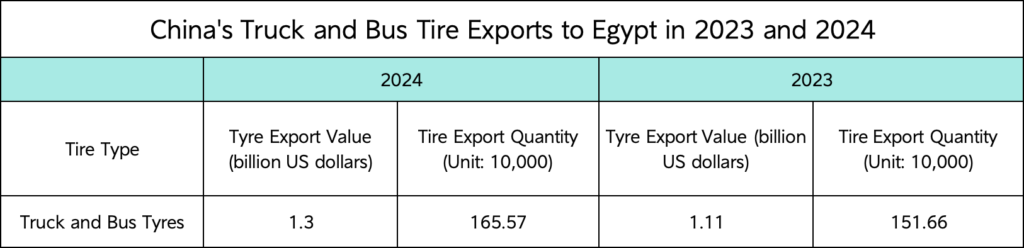

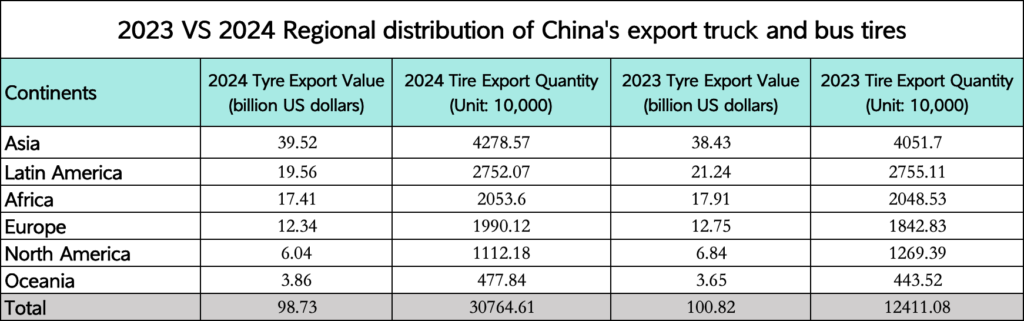

Egypt is a strategic fulcrum for China’s tyre export to the African market. In 2024, China exported more than 1.6 million truck and bus tyres to Egypt. At its peak, Chinese tire products occupied a 35% market share. After the adjustment of the tire tax rate, taking a truck tire with a unit price of 3,000 yuan as an example, the highest tax rate of 56% will increase the tax on a single tire to 1,680 yuan, and the terminal selling price will exceed 250 US dollars. The price difference with Egyptian local tire brands has narrowed to less than 10%, and the tire price advantage has disappeared.

In contrast, the competition in Thailand has intensified: the tyre tax rate in Thailand is only 6%-20%, coupled with the low cost of its Southeast Asian industrial chain (the price of natural rubber is about 15% lower than that in China), further squeezing the living space of Chinese tire products in the Egyptian tire market.

Truck Tire Market Supply Chain Chain Reaction

Egypt is a logistics hub for Chinese tires to radiate to North Africa and West Africa. The tax rate adjustment has led to obstruction of the “Middle East-North Africa-West Africa” triangular logistics network, and the penetration rate in surrounding markets such as Algeria and Nigeria has also declined simultaneously.

Conclusion

The adjustment of Egypt’s anti-dumping tyre tax is a trade barrier in truck tire market on the surface, but in fact it is a catalyst for the reconstruction and upgrading of the global industrial chain. The Chinese tire industry can only break through the wave of trade protectionism by breaking the cost dependence through technological innovation, dispersing risks through global layout, and reconstructing the value chain through business models.